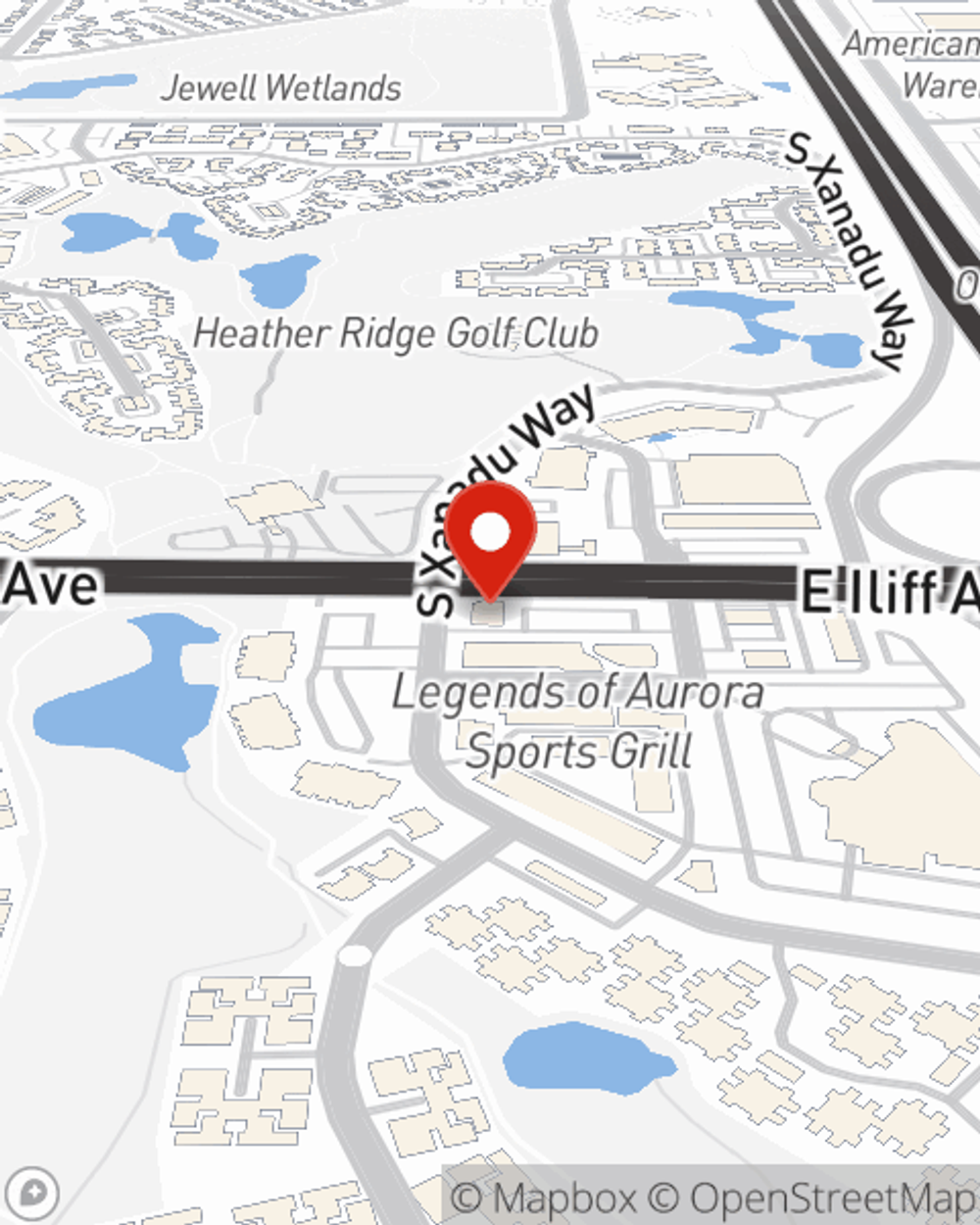

Business Insurance in and around Aurora

Aurora! Look no further for small business insurance.

Helping insure small businesses since 1935

- Aurora

- North Aurora

- South Aurora

- Arapahoe County

- Heather Gardens

- Denver

- Windsor Gardens

- Commerce City

- Adams County

- Parker

- Northfield

- Green Valley Ranch

- Lowry

- Greenwood Village

- Centennial

State Farm Understands Small Businesses.

Running a small business comes with a unique set of highs and lows. You shouldn't have to work through those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, worker's compensation for your employees and errors and omissions liability, among others.

Aurora! Look no further for small business insurance.

Helping insure small businesses since 1935

Insurance Designed For Small Business

At State Farm, apply for the outstanding coverage you may need for your business, whether it's a florist, a window treatment store or a sporting good store. Agent Joel Kruschwitz is also a business owner and understands your needs. Not only that, but exceptional service is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

Agent Joel Kruschwitz is here to review your business insurance options with you. Reach out Joel Kruschwitz today!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Joel Kruschwitz

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.